Reliance Industries’ Stock Fell By 3%: Market Crash?

Reliance Industries, a massive player in India’s industrial and business landscape, has been in the news for a sharp decline in its stock prices recently. The fall in stock prices has raised concerns among investors, analysts, and market enthusiasts. In this blog, we will dive into the possible reasons behind the fall in Reliance Industries’ stock prices, what factors are at play, and what investors can expect going forward.

Recent Decline in Reliance Industries’ Stock

Reliance Industries’ shares have seen a significant drop of around 7% in just a few days, sending shockwaves through the Indian stock market. On October 3, 2024, Reliance’s stock hit an intra-day low of ₹2,827 on the National Stock Exchange (NSE), marking a notable decline. The company, which holds a market cap of over ₹15 lakh crore, has seen a fall in investor confidence, sparking widespread speculation on the causes of this decline.

Key Factors

1. Selling Pressure from Foreign Institutional Investors (FIIs)

One of the most prominent reasons for the recent fall is the selling pressure from Foreign Institutional Investors (FIIs). In the last week alone, FIIs have sold equities worth more than ₹8,500 crore in the Indian market, with Reliance being one of the most impacted stocks. This withdrawal by foreign investors can be attributed to broader market trends and concerns, leading to a drop in demand for Reliance shares.

FII ownership in Reliance Industries has hit its lowest point in six years, further contributing to the downward pressure on the stock. As FIIs make up a significant portion of the trading volume in major companies, any large-scale selling can have a considerable impact on stock prices.

2. Weakness in Reliance’s Oil-to-Chemical (O2C) Business

Reliance Industries’ oil-to-chemical (O2C) segment, a crucial revenue stream for the company, has been facing challenges recently. The O2C business processes crude oil into chemicals and fuels, making it one of the company’s key income-generating operations. However, weaker global demand for oil, along with fluctuating crude oil prices, has led to a decline in margins for this division.

This dip in O2C margins has sparked concerns among investors, especially since this segment plays a central role in Reliance’s overall earnings. Any significant weakness in this area can lead to lower-than-expected earnings, and this has been a critical driver of the recent fall in stock prices.

3. Technical Weakness in Stock Performance

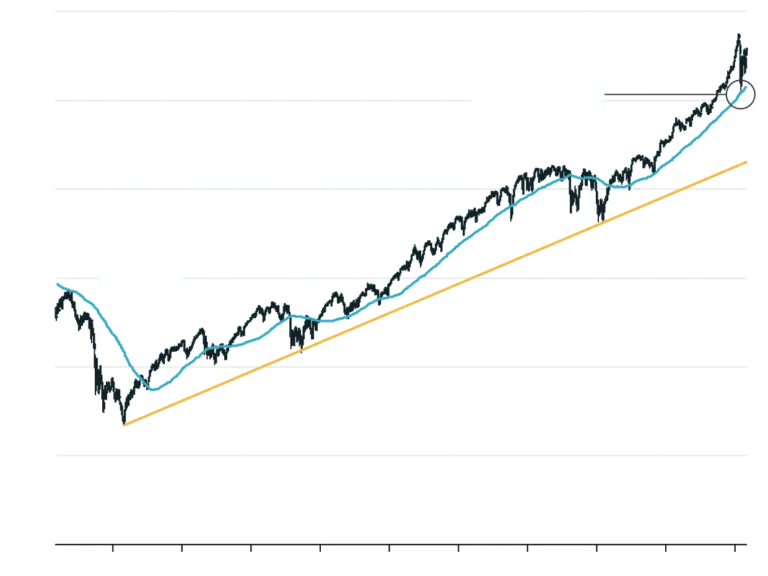

Reliance Industries’ stock has also shown technical signs of weakness, breaking through key support levels. The stock recently dropped below its 200-day moving average, an important technical indicator that signals a possible bearish trend. This has further amplified concerns among short-term traders and investors, leading to additional selling.

Moreover, the Relative Strength Index (RSI) for the stock has shown that it is entering oversold territory. While this doesn’t necessarily guarantee further decline, it indicates a loss of momentum, which could make it harder for the stock to recover in the short term.

4. Speculation Around Bonus Share Issue

Amid the negative news, there has been some positive anticipation regarding Reliance’s recent announcement of a 1:1 bonus share issue. Typically, bonus issues are seen as a positive move that rewards shareholders by issuing additional shares, which can often boost investor confidence. However, this time, the speculation around the bonus share issue hasn’t been enough to counterbalance the broader negative sentiment in the market.

While some investors are looking forward to the bonus issue, the overall market outlook for Reliance remains cautious, especially with concerns surrounding its core business operations.

5. Broader Market Correction

It’s also essential to recognize that the Indian stock market as a whole has been going through a correction. Many large-cap stocks, including Reliance, have been affected by the broader market dynamics, which include global economic uncertainties and local macroeconomic concerns. These market-wide corrections can lead to dips in even fundamentally strong companies, as we’re witnessing with Reliance.

What’s Next for Reliance Industries?

While the recent fall in stock prices has caused some jitters, Reliance Industries remains a dominant force in India’s economy, with strong long-term fundamentals. The upcoming quarterly earnings report will be crucial in determining the company’s ability to navigate the current challenges, particularly in the O2C segment.

Keep an eye on any updates regarding Reliance’s business operations and its bonus share issue, which could help stabilize the stock. For those looking to invest, the current dip might present a buying opportunity, provided they have a long-term investment horizon.

Key Points

- Foreign Institutional Investors have offloaded large quantities of Reliance shares, contributing to the price fall.

- Weak margins in the Oil-to-Chemical segment have dampened earnings expectations.

- Technical indicators signal short-term weakness in the stock.

- Bonus share speculation has not been enough to offset broader market concerns.

Missed Something?

A Short Message by FINOLOGIC

At Team Finologic, we’re committed to helping you navigate the world of finance and the stock market in the simplest way possible. Whether you’re a beginner or someone looking to deepen your understanding, we break down complex financial concepts so you can make informed decisions with confidence. From market trends to investment strategies, we’re here to guide you at every step, ensuring that your financial journey is smooth and well-informed. Let us be your partner in mastering finance, one step at a time!

At Finologic, we offer a range of resources to help you stay ahead in the financial world. Here’s what you can explore on our platform:

- IPO Dashboard: Get detailed insights and updates on upcoming and past Initial Public Offerings (IPOs), so you can make timely and informed investment decisions.

- Financial Calculators: From loan EMIs to retirement planning, our easy-to-use calculators are designed to help you manage and plan your finances with precision.

- Financial Blogs: Dive into our blogs that cover the latest trends, news, and expert advice on all things finance, tailored for both beginners and seasoned investors.

- Cryptocurrency Information: Stay updated on the fast-evolving world of cryptocurrencies, including market movements, expert analysis, and investment strategies.

- ETF (Exchange-Traded Fund) Scanner: Discover and compare the best ETFs with our powerful scanner, helping you find the right funds to match your investment goals.

With Finologic, you have all the tools and information you need to make smart financial choices!