Bitcoin Back Up at 40k: A Cryptocurrency Comeback or Catapult to Chaos?

Remember the frosty December winds that sent shivers down investors’ spines, with Bitcoin plummeting into the $15,000 ballpark? Those days seem like a distant blizzard now, as Bitcoin has roared back to life, reclaiming its throne at $40,000 after three tumultuous months. But what magic potion fueled this resurgence, and where is this digital dragon headed in 2024? Buckle up, fellow crypto curious, because we’re about to delve into the recent rally, uncover Bitcoin’s storied past, and peek into its possible future, all in plain English.

From Crypto Crypt to Bullish Breakout:

Think of December as a time when investors were huddled in crypto caves, shivering with fear after Bitcoin took a nosedive. The sun is shining on the digital landscape, and Bitcoin is basking in the warmth of a $40,000 price tag. What turned the tide? Here are some key factors:

- Wall Street Whales Dive In: Imagine sharks circling a school of fish, but instead of fins, they have briefcases. That’s what’s happening with Big Banks like BlackRock and Goldman Sachs. They’re dipping their toes (and maybe even a fin) into the crypto waters, investing in Bitcoin-backed funds and even offering custody services. This institutional validation is like a giant “thumbs up” for Bitcoin, giving it a confidence boost and pushing prices up.

- Regulatory Thaw: Remember that icy breath of regulations that threatened to freeze the crypto landscape? It’s starting to warm up a bit. Countries like India and Australia are softening their stance, while the US Securities and Exchange Commission (SEC) seems more open to approving Bitcoin Exchange Traded Funds (ETFs). Less regulatory pressure is like removing a heavy block from Bitcoin’s leg, allowing it to run faster.

- Macroeconomic Maneuvers: Imagine the global economy as a rollercoaster; lately, it’s been a bit bumpy. But there are signs of smoother tracks ahead. Inflationary fears are cooling down, and central banks are hinting at slowing down interest rate hikes. This easing of the economic squeeze potentially frees up some money for investments, and some folks like to park that money in Bitcoin, making it climb higher.

A Walk Down Bitcoin Memory Lane:

Before we peer into the future, let’s stroll down memory lane and appreciate the fascinating journey of Bitcoin, the OG of cryptocurrencies. In 2009, a mysterious figure known only as Satoshi Nakamoto (think of them as the crypto Robin Hood) unleashed this digital phoenix from the ashes of the 2008 financial crisis. Bitcoin promised a decentralized, secure, and transparent financial system, where trust wasn’t in big banks but in lines of code. Early adopters, mostly tech-savvy cypherpunks, saw the potential, and the price started its wild ascent.

Through boom-and-bust cycles, regulatory battles, and even existential threats, Bitcoin persevered. It weathered storms like the Mt. Gox hack (think of it as a giant digital bank robbery) and the Silk Road takedown (imagine a shady online marketplace shutting down), emerging stronger each time. From a niche curiosity to a mainstream buzzword, Bitcoin has woven itself into the fabric of our digital age, influencing not just markets but also inspiring a whole new ecosystem of blockchain innovation (think of it as a revolutionary new way of recording information).

Crystal Ball Gazing: Where Does Bitcoin Go From Here?

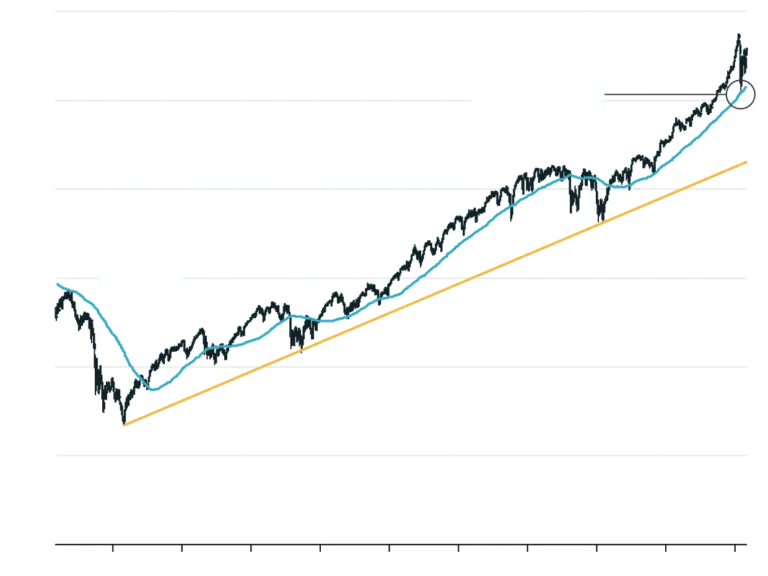

Predicting the future in the ever-volatile crypto realm is akin to riding a bucking bronco blindfolded. However, based on current trends and expert insights, here are some possible scenarios for Bitcoin in 2024:

- Consolidation and Climb: The recent surge might be followed by a period of chill, like the eye of a hurricane, where Bitcoin rests around the $40,000 mark. But if the positive factors mentioned earlier hold strong, we could see another upward climb towards the $50,000-$60,000 range by the end of the year, like a determined climber scaling a mountain.

- Black Swan Blues: The crypto world is prone to unforeseen events, like regulatory crackdowns or major security breaches. These black swan events (think of a giant, unexpected bird disrupting the market) could trigger another price plunge, potentially bringing Bitcoin back down to the $20,000-$30,000 zone, like a skier falling down a slope.

- Sideways Shuffle: The market might stay in a holding pattern, oscillating around the $40,000 mark for most of 2024. This sideways shuffle would indicate both optimism and caution, with investors waiting for clearer signals before making big moves.

Conclusion:

Bitcoin’s recent rally is a testament to its enduring resilience and the growing belief in its long-term potential. But the crypto landscape remains fraught with uncertainties. Remember, Bitcoin is a high-risk, high-reward asset, and investing in it requires a healthy dose of research and a strong tolerance for volatility. So, buckle up, stay informed, and enjoy the ride, fellow crypto-curious! The Bitcoin roller coaster promises to be even more thrilling in 2024.

However, before you jump on this digital bandwagon, keep a few things in mind:

- Do your research: Don’t invest based on hype or social media trends. Understand the technology, the risks involved, and the potential benefits before putting your hard-earned money into Bitcoin.

- Invest responsibly: Only invest what you can afford to lose. The crypto market is volatile, and prices can swing dramatically.

- Beware of scams: The crypto world is unfortunately rife with scams and fraudulent schemes. Never invest in anything that sounds too good to be true, and always double-check the legitimacy of projects before investing.

Bitcoin’s comeback is exciting, but remember, it’s just one chapter in the ever-evolving story of cryptocurrency. Embrace the learning, manage your risks, and enjoy the ride. As for where Bitcoin is headed in 2024, only time will tell. But one thing’s for sure: digital currency has a way of keeping us on the edge of our seats, watching, waiting, and wondering what the next twist in its tale will be.