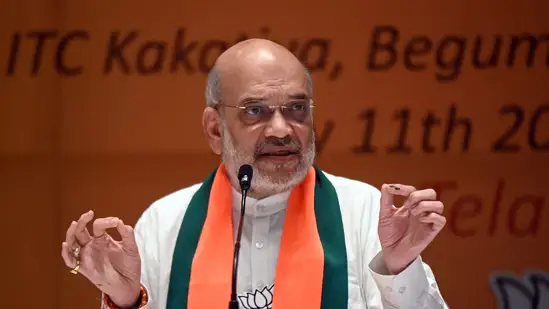

Amit Shah’s Shocking Statement – Market And Elections 2024

The interplay between politics and the stock market is a topic of keen interest, especially during significant events like elections. Amit Shah, the Union Home Minister recently shared his views on the relationship between the stock market and the upcoming general elections in 2024. His advice to investors to buy before June 4, the date of the Lok Sabha election outcome, has sparked discussions and raised questions about the potential impact of political events on financial markets.

Table of Contents

Market Volatility and Political Speculations – Amit Shah

The stock market has experienced notable fluctuations in recent times, prompting speculation about the extent to which these movements are tied to the ongoing Lok Sabha elections. However, Amit Shah has cautioned against directly linking market movements to electoral outcomes. He points out the complexity of market dynamics, which are influenced by a multitude of factors beyond political events. Market volatility, therefore, may not solely be attributed to election-related factors.

Shah’s optimism regarding market performance post-election stems from historical trends. He suggests that the formation of a stable government at the Centre often leads to a rally in the stock market. His prediction of a potential rise in the market is tied to expectations of a stable Modi government, with projections indicating over 400 seats for the BJP/NDA alliance.

Analysts’ Perspectives on Election Outcomes

Insights from financial analysts and institutions provide a more nuanced view of potential market scenarios post-election. Nomura India and MUFG Bank, among others, highlight the significance of policy continuity and potential reforms based on the election outcome. These analyses delve into the potential impact of government policies on sectors such as infrastructure, manufacturing, taxation, and foreign investment.

Investment Strategies and Market Sentiments, POV: Amit Shah

The concept of “buying the dip” in the stock market is discussed in light of recent market fluctuations. This strategy involves purchasing assets when their prices are low, with the expectation of future appreciation. However, investors are advised to exercise caution and conduct thorough research before making investment decisions. Market sentiments, influenced by political speculations, economic data, global trends, and investor behavior, play a crucial role in shaping investment strategies.

Anticipation regarding the market reaction post-election results is a topic of considerable interest. Experts and market observers anticipate various scenarios based on the election outcome. Factors such as policy stability, structural reforms, investor sentiments, and global economic conditions are expected to influence market trends in the short and medium term.

Global and Domestic Factors Influencing Market

While electoral outcomes can impact market sentiments, it’s essential to consider broader economic factors. Global economic trends, foreign investments, trade policies, inflation rates, interest rates, and domestic economic indicators all contribute to market behavior. Understanding the interconnectedness of these factors is crucial for investors navigating volatile market conditions.

Investor Caution and Risk Management

Amid market uncertainties, investors are reminded of the importance of caution, risk management, and informed decision-making. Blindly following market speculations or political narratives without thorough analysis can expose investors to financial risks. Diversification, asset allocation, and staying informed about market trends and economic developments are essential components of effective risk management.

Beyond immediate market reactions to electoral outcomes, attention shifts to the long-term economic vision and development agenda. The government’s role in fostering economic growth, infrastructure development, job creation, and policy reforms is crucial for sustained market stability and investor confidence. Investors often assess government policies, fiscal measures, regulatory frameworks, and industry-specific initiatives to gauge long-term investment opportunities.

Conclusion

The intersection of politics and finance creates a dynamic and complex landscape for investors and market participants. Amit Shah’s insights, coupled with analyses from financial institutions and market experts, offer valuable perspectives on the intricate relationship between electoral outcomes and financial markets. As investors navigate uncertain times and market volatility, informed decision-making, risk management strategies, and a long-term investment approach remain paramount for financial success and wealth preservation.

The statement is both exciting and a topic of deep thinking. The General Elections Of 2024 is in process, and there are a lot to happen in the upcoming future.

STAY UPDATED!!

finologic.in